News

Assembly candidate caught with N326m, $610,500 in cash

…..Ismaila Atumeyi, the New Nigeria Peoples Party’s Kogi State House of Assembly candidate, was detained with N326 million and $140,500 cash by the Economic and Financial Crimes Commission. The PUNCH can attest to this.

Atumeyi, who is running for the Kogi State House of Assembly seat of Ankpa 11, was apprehended on Sunday, October 30, 2022, with Joshua Dominic, an accused serial fraudster, in a sting operation at Macedonia Street, Queens Estate, Karsana, Gwarinpa, Abuja.

Abdumalik Femi, a former bank employee who reportedly offered inside knowledge that allowed the syndicate’s attack on the bank, was also detained in connection with the fraud.

Wilson Uwujaren, an EFCC official, verified to our correspondent that Femi was apprehended today (Tuesday, November 1, 2022) at the Radisson Blu Hotel in Lagos.

“Following his arrest, a search of his residence in Morgan Estate, Ojodu was performed, and a total of $470,000 USD was found.”

“The suspects’ arrest came after months of inquiry into the hacking of one of the commercial banks by a network of fraudsters who carried off a N1.4billion theft,” he added.

…..The syndicate reportedly sent N887 million into the account of Fav Oil and Gas Limited, from which the funds were transferred to multiple Bureau de Change operators and auto dealers for exchange into US dollars and the purchase of high-end vehicles.

Dominic, who has been arrested multiple times for fraud, reportedly assisted Atumeyi in perfecting the hacking strategy through Abdumalik. Dominic, a self-proclaimed financial expert and Managing Director of Brisk Capital Limited, was arrested in May 2021 by the Nigeria Police Special Fraud Unit for an alleged N2 billion investment fraud. In a bogus investment scheme, he reportedly duped over 500 people.

The two individuals apprehended in Abuja also had two Range Rover Luxury SUVs confiscated.

Uwujaren stated that once the investigation was completed, the suspects would be charged in court.

Meanwhile, the commission is concerned about the increasing number of cyber-attacks on banks, as well as the institutions’ unwillingness to report such breaches to law enforcement.

While stressing that such reluctance will only empower criminals, the EFCC urges financial institutions to work with it to protect the financial sector from cyber-attacks.

…….Following the recent announcement by the Central Bank of Nigeria of plans to redesign and re-issue higher denominations of the naira, the EFCC warned Bureau de Change operators to be wary of currency hoarders who would try to take advantage of the opportunity to offload the currencies they had illegally stashed away.

-

Osun News4 days ago

Osun News4 days agoOsun Poly Staff Stabbed During Exam Supervision (Photo)

-

Osun News4 days ago

Osun News4 days agoBank Manager Arrested By Police In Osun Over Alleged N650.8m Fraud

-

Politics7 days ago

Politics7 days agoTinubu Reacts To Rivers Political Crisis, Sends Strong Message To Wike, Others

-

Osun News6 days ago

Osun News6 days agoGov Adeleke Installed As Asiwaju Of Edeland

-

Osun News17 hours ago

Osun News17 hours agoFull list of 22 new federal appointees from Osun state emerged

-

Metro/Crime24 hours ago

Metro/Crime24 hours agoPopular Osun Monarch Joins Ancestors

-

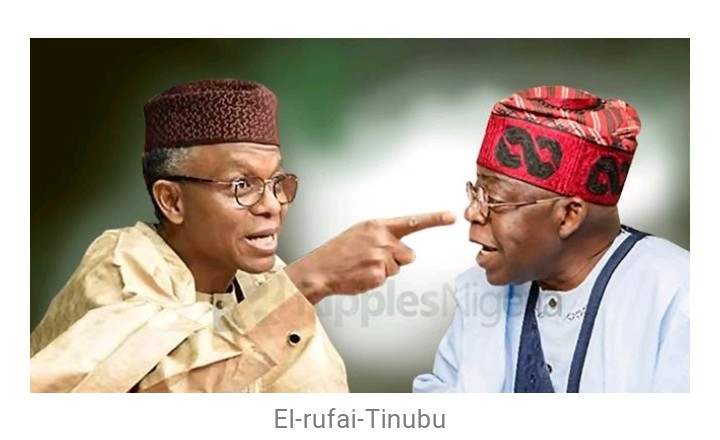

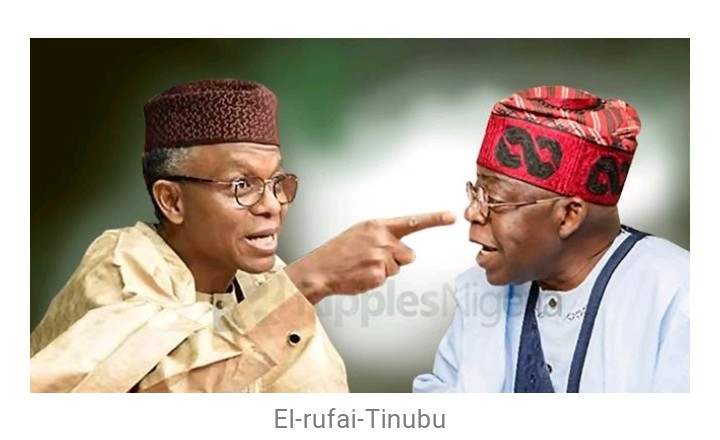

Politics7 days ago

Politics7 days agoReason El-Rufai couldn’t become Tinubu’s minister’

-

News4 days ago

News4 days agoOyetola’s spokesperson, Omipidan honoured by Kings University